News

Milliman Releases White Paper Exploring Connections Between Flood Insurance and Climate Gentrification in Southeast Florida

December 19, 2019

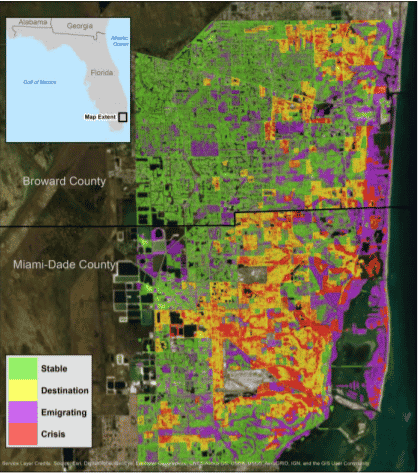

Milliman, one of the largest providers of actuarial services globally, recently released a white paper exploring the intersection of future flood hazard and income levels in Broward and Miami-Dade Counties, as well as how flood insurance premiums may incent gentrification as a result of climate risk. The study first classified the region into four classifications discussed in the paper as quadrants: high-income, low-hazard (“Stable”), low-income, low-hazard (“Destination”), high-income, high-hazard (“Emigrating”), low-income, high-hazard (“Crisis”), based on U.S. Census estimates of poverty status by household (defined the 25% of Census Block Group having the highest proportion of households living below the poverty line as “low-income”), and a defined measure of flood hazard in the region (areas experiencing >1ft. water depth for one-in-one hundred year flood event).

The authors then calculated the total insurable value within these four classifications, and estimated the NFIP premiums for each property. Results indicated the average flood rate against full home value is notably lower in the ‘Emigrating’ (higher-risk, higher-income) quadrant than in the ‘Destination’ quadrant. This suggests a potential geographical mismatch between the NFIP’s current rating plan and local flood risk, one that may be exacerbated by climate change. Additionally, the analysis found that current federal flood insurance prices may also be imperfect risk signals due to limitation in coverage amounts, which may work to obscure risk signals that would otherwise incentivize gentrification. This information will aid local leaders in better understanding the factors driving movement across the region, and will help inform local resilience planning, investment, and policies to support the communities most vulnerable to physical risk and displacement.